Your organisation faces a multitude of operational challenges on a daily basis but one particular area that continues to grow in complexity is KYC. Previously considered little more than a tick-box exercise, today, the volume of requirements and the pace at which they change can often leave senior leaders with more questions than answers.

Below, we explore five key corporate challenges and discuss how technology and automation can help overcome them.

1. You don’t know what you don’t know

There has been a raft of global anti-money laundering and counter-terrorist financing regulation over the past decade, which has made KYC compliance more complex and time-consuming for corporates around the globe to transact in financial products, or even to maintain a simple bank account. But as the world – and organised crime – becomes ever more sophisticated and digitally connected, regulations and requirements will only become more stringent.

Keeping abreast of the evolving rules becomes a risk issue that warrants a high degree of management oversight. Aside from the transactional impact of not being able to execute a time-sensitive deal with a specific financial counterparty, a far more material risk is the reputational damage that could arise if the internal controls and governance processes were found to be lacking in this area. As with all governance, clear and transparent feedback loops are vital. Using an audit trail, a company’s management team needs to be confident that processes are being correctly followed and hence the risks are being appropriately managed.

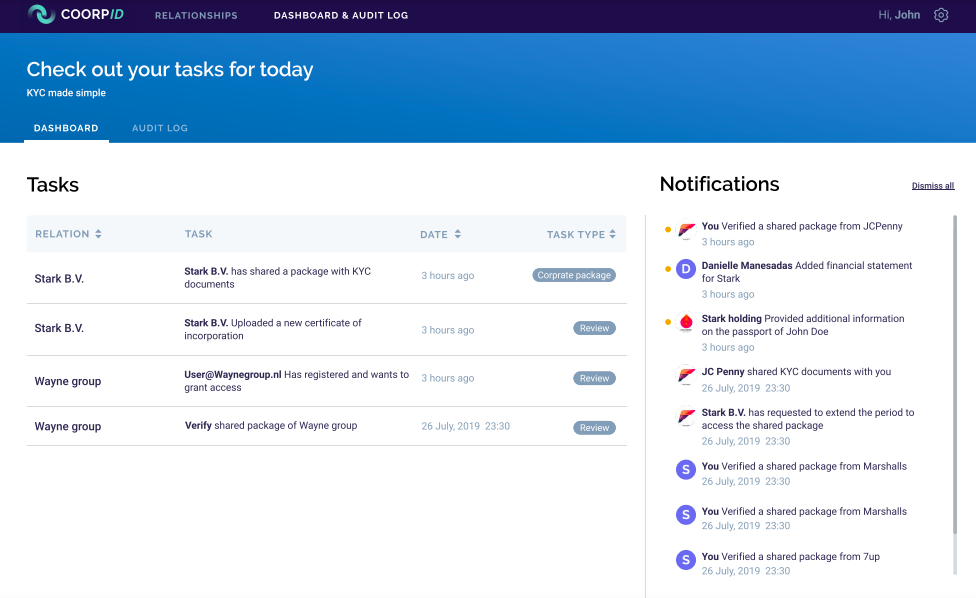

Working with a KYC partner that fully understands the regulations and, specifically, the importance of the timely application of the rules (both existing and new) to your business can materially reduce this reputational risk. An efficient online platform incorporates all the relevant guidance and regulatory rationale and provides a clear indication of what is required for your business and when. This includes accounting for regulatory variations across geographies and jurisdictions where applicable and highlighting any information gaps in real time. Meanwhile, with all KYC activity recorded in one system, an accurate and complete audit trail can be completed for each relationship.

2. Resources, cost and time

Corporates typically provide KYC-related documents and information on an ad hoc basis, as and when demanded by their financial institution (FI) counterparties. Historically, this would be a piecemeal manual process which, by its nature, resulted in numerous inefficiencies, a lack of transparency and multiple opportunities for human errors or delay. With swiftly changing regulatory needs and a requirement to refresh independent source documents more frequently, more resources and a deeper level of understanding are required. Compounding this increased operational cost, corporates have been faced with the serious issue that KYC compliance delays have denied them valuable (time-sensitive) commercial opportunities.

Today, expectations have shifted such that KYC data must be kept up-to-date and revisited regularly, even if you are doing business with the same partner. The industry widely predicts that this so-called ‘Perpetual KYC’ will become the norm. The latest updates to AML regulations reflect this shift, with particular focus on reporting material change in a company. It is now a legal requirement for an organisation to provide their FI with the most up-to-date entity information available at any given time. Failure to do so leads to a dilution of KYC statements and, in some cases, termination of the business relationship.

Having a dynamic online platform for KYC allows you to, for example, build and adjust the ownership structure of your company over time. It monitors any changes in company details and circumstances as they arise and provides a clear oversight for both parties.

3. Duplication of efforts across all FI relationships

All FIs conducting business with a corporate will have to perform KYC on businesses and individuals from scratch. For corporations, this means providing multiple different versions of the same information to suit each counterparty’s KYC template. There is currently no standardisation to this data request and lack of consistency can lead to confusion, mass duplication and delay.

Flipping the problem on its head, creating a centralised, updated, secure, KYC workflow tool to maintain one single source of the truth can provide a simple – but meaningful – advance from the current position. A smooth KYC process relies on effective information sharing and, with an online system, all relevant documents can be uploaded at the same time, with automatic prompts helping to categorise and structure the data immediately.

With all parties having a single collaborative view of the KYC status, responsibility and ownership of tasks is clear, bottlenecks can be identified and updates or refreshing of data are quick and accurate.

4. Management and security of KYC data

Even relatively small organisations can have numerous legal entities, company officers, shareholders, and ultimate beneficial owners. The accurate recording, mapping and constant updating of this web of interrelated data can become a significant KYC challenge.

While the management of an ever-growing volume of data is a logistical and IT challenge, the security of the information flow can stretch into risk areas, including data privacy and GDPR. The latter imposes strict rules and restrictions on how personal data is stored, managed and transferred.

The historical solution of sending certified documents via post or email provided neither corporates nor individuals with any comfort that their confidential data was only being seen by the intended recipient and used for the purpose intended.

As data privacy laws increase and societies moves more ‘online’ with personal risk increasing, the security and audit trail of appropriate access to this information becomes more important.

By using a central repository, companies can retain control over their data, allowing limited access to confidential documents and having a real-time view of who has seen the documents and when. Automation enables transparency on the entire process of obtaining, storing and managing the data and maintains the necessary records, or proof, that GDPR has been adhered to.

5. Future-proofing your KYC process

While the evolving KYC landscape cannot be predicted, corporates would be wise to evaluate now how technological advances can efficiently support them with a solution fit for the future.

Keeping abreast of technological changes will be a vital enabler of ensuring compliance as well as reducing the associated administrative, cost and risk burdens. Agile businesses that have the framework in place to adapt to regulatory changes as they arise will be in a much better position than those that must re-engineer their business practices at every step.

CoorpID offers an intuitive solution that gives a real-time overview and a central location to store and manage all KYC-required data. This centralised hub is designed to maximise the quality of the KYC process for both parties by streamlining collaboration, driving efficiency and providing the highest levels of security.

Click here and talk to one of our experts to learn how CoorpID can significantly reduce the time and money spent on KYC in your business.