Streamline and simplify your Know Your Customer compliance process

CoorpID makes it easy to store and structure your KYC company documents and share them with your banks and business partners.

We minimise the hassle of KYC for corporates by means of a secure digital vault that you can use to store, organise and share all your KYC-related documents. With CoorpID, you will be able to handle multiple KYC compliance requests for all the entities within your corporation far more efficiently. CoorpID offers an audit trail function that enables you to remain in control of and track the information that you share. CoorpID offers bank-level security so that you can exchange confidential and sensitive information securely.

How CoorpID is is offering value to multinational corporates

These days, multinational corporations are faced with numerous KYC information requests from multiple banks on a daily basis. As a result, KYC compliance is becoming more and more of a burden consuming valuable time and resources that could be employed more profitably elsewhere. Fortunately, CoorpID is here to help. With CoorpID’s centralised secure digital repository, you can easily store, structure, track and exchange KYC-related documents with multiple financial institutions and business partners. Contact us for a demo today and find out just how easy it is to incorporate CoorpID in your KYC process.

Oh great, only 100 KYC requests to go, easy! No one ever said that…. At least until now.

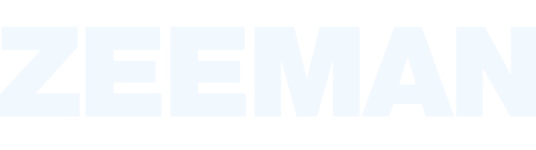

Banks and other financial institutions are having to comply with increasingly strict Know Your Customer (KYC) and Customer Due Diligence (CDD) requirements when onboarding customers, performing reviews, or providing new products and services. As a result, corporations, in particular multi-entity corporations operating across several geographies, are being faced with an unprecedent number of KYC information requests a year from their financial partners. When dealing with KYC information requests from banks, multiple departments are involved: Finance, Treasury, Tax, Legal, Compliance. This doesn’t make life any easier, does it?

Are KYC requests slowing down your business and affecting your financial maneuverability? Then it might be time to start working with our online central repository. Learn more about minimising the KYC hassle for corporates

Receive your activation email

Add & structure your company's KYC documents

Share your KYC documents with your banks

Keep track of the information you shared

About CoorpID and KYC for corporates

Handle KYC requests quickly and efficiently from one central location.

CoorpID was developed within ING’s innovation department, in collaboration with 20 corporate customers from several countries. Since its launch, more than 500 corporate users have used CoorpID to share their confidential KYC company documents with ING and other financial institutions. We are continuously working on improvements and new features based on customer feedback, our KYC expertise, new developments regarding KYC and CDD best practices and rules and regulations.

Global collaboration

Inter-departmental collaboration across the globe

Easy to set-up

Plug 'n play without IT involvement

Focus on what matters

25% average timesaving per KYC review

Safe & compliant

Encrypted storage, GDPR proof and servers that are located within Europe

CoorpID is a centralised, secure digital repository that corporations can use to store, structure, track, and exchange KYC-related documents with multiple financial institutions and business partners. CoorpID is a plug ‘n play web-based tool and can easily be integrated into existing workflow tools.

How is dealing with KYC requests organised within your company? Is it time to streamline and accelerate this process via a central online repository? Or does handling KYC company data requests the old-fashioned way, via email, still work for you? let us know via sales@coorpid.com.

Minimising the hassle of KYC for corporates.

With CoorpID, both large corporations and their financial business partners can reduce repetitive manual tasks, avoid errors, save time, and cut costs during the KYC process. See what some of our clients are saying about using CoorpID.

“CoorpID clearly adds value for Hapag-Lloyd, we can use it as a central repository and manage our KYC process at the same time. In addition, we can share relevant information straight away with just one click on a button.“

Senior Director, Asset & Structured Finance, Hapag-Lloyd AG

“CoorpID is an ideal tool to streamline and standardise the information-gathering process. ING uses CoorpID as part of our KYC improvement journey as it helps to reduce the KYC compliance burden for both customers and the bank.“

Global Head KYC ING Wholesale Banking

“Managing KYC requests has never been this easy. Thanks to CoorpID, we are saving time and increasing the efficiency of our whole KYC process.“

Compliance Manager, Lundin Energy

“CoorpID’s central system helps us save time and enables us to share documents swiftly, securely and easily.“

Zeeman textielSupers

Latest insights

As constructive rebels, we balance expertise and experimentation to create the best possible user experience for our users. To keep up with the market, we regularly post insights, user stories and other news items.

A corporate treasurer’s perspective on KYC complexities

With complex KYC continuing to frustrate corporate treasurers, automation emerges as a solution.

The growing inefficiency of traditional KYC outreach methods

Replace outdated KYC data collation with secure outreach and document management platforms.

Simplifying corporate KYC data exchange

Streamline KYC, improve security, compliance, and traceability with CoorpID data exchange.