Financial institutions have been exposed to the risk of financial crime, such as money laundering and terrorist financing, for decades but the scale of this risk has grown considerably over recent years. As organised crime becomes ever-more sophisticated, the global efforts to combat these risks – and the regulatory requirements to support them – have had to evolve in tandem.

A major challenge now facing regulated companies and their customers is how to keep track of this complex set of rules, and adopt them into their daily processes, without hindering their business success. Embracing the right technology can transform an unwieldy problem into a positive force, creating wide-ranging benefits across the organisation.

What is KYC?

Know Your Customer or Know Your Client (both KYC) is a generic term used to describe the process that financial institutions must adhere to before, during and after dealing with customers in financial products and services. The primary requirement – and the one that most people will be familiar with – is the identification process, which typically involves the formal identification of individuals, companies, company officers and persons with significant control, down to photo ID and proof of home address details. Inside the financial institution, this information must then be cross-checked against multiple databases to look for any known links or abnormalities. Included here, for example, is a check for politically exposed people (PEPs) who – because they hold a position of influence – trigger additional due diligence requirements.

Intertwined with the screening of individuals is a requirement to create a detailed and clear understanding of the customer’s specific business. What does it do? Who are its clients and suppliers? How does it compare to other ‘similar’ businesses in structure/margin/geography? The purpose of this data gathering is to enable the financial institution to build an accurate risk profile of the client. This allows the institution to make informed judgements as to whether to go into, or continue doing, business with a particular customer and, where a business relationship is pursued, it enables the appropriate monitoring measures to be put in place.

Why is it important?

It is impossible to produce a definitive global estimate of the amount of money exchanged in illegal transactions every year but there is no denying that it is a huge issue. A United Nations report estimated that, in 2009, criminal proceeds amounted to 3.6% of global GDP. This figure fits within the widely quoted estimate from the International Monetary Fund, which stated in 1998, that the aggregate size of money laundering was somewhere between two and five percent of the world’s gross domestic product. [1]

The challenge is significant and its impacts are wide-ranging – from funding weapons of mass destruction to the illegal wildlife trade. As technological advancements continue, so do the ways in which financial criminals cheat the system. Regulations will continue to become more complex, with further reviews and tightening required to keep apace.

Know your customer (KYC) is the first crucial step towards a safe, secure and compliant organisation. It allows all parties to protect themselves – and the entire financial system – by ensuring that they are conducting business legally and with legitimate entities.

Aside from being a legal requirement, KYC is good business practice. By instilling transparency and governance requirements, the financial institution will only offer products and services that suit that individual client’s circumstances. This transparency also enables the organisation to limit the impact of their business activities on the wider community and the environment.

The challenge is how to meet these ever-changing compliance requirements without damaging client relationships or slowing transactions to the point of unviability.

What is the current process?

Today, KYC remains a time-consuming and costly exercise and this is because it remains a largely manual process for both financial institutions and their customers.

Large compliance teams at financial institutions sort through unstructured data, spending hours on manual data-entry, information checking and screening, and contacting customers for missing information. Customers in turn are completing KYC forms for each financial relationship in an ad hoc manner, adapting their data to multiple formats and duplicating their efforts.

Much of this KYC data is still captured in paper or PDF formats and sent by email or traditional post, and data is gathered and assessed by multiple compliance teams, often working in product silos. In a nutshell, data is not standardised or shared effectively.

How can technology help?

The many challenges faced by both parties have led to a rise in automation technology and central repositories for data storage, which are enabling smoother KYC processing.

Having a single secure digital platform allows customers to easily store, manage and synchronise their KYC documents for multiple business partners. Instead of providing separate documents to fulfil each financial counterparty’s KYC format, they need only record their data in one place and in one format. This data can then be authenticated and transmitted securely to all financial counterparties at the press of a button.

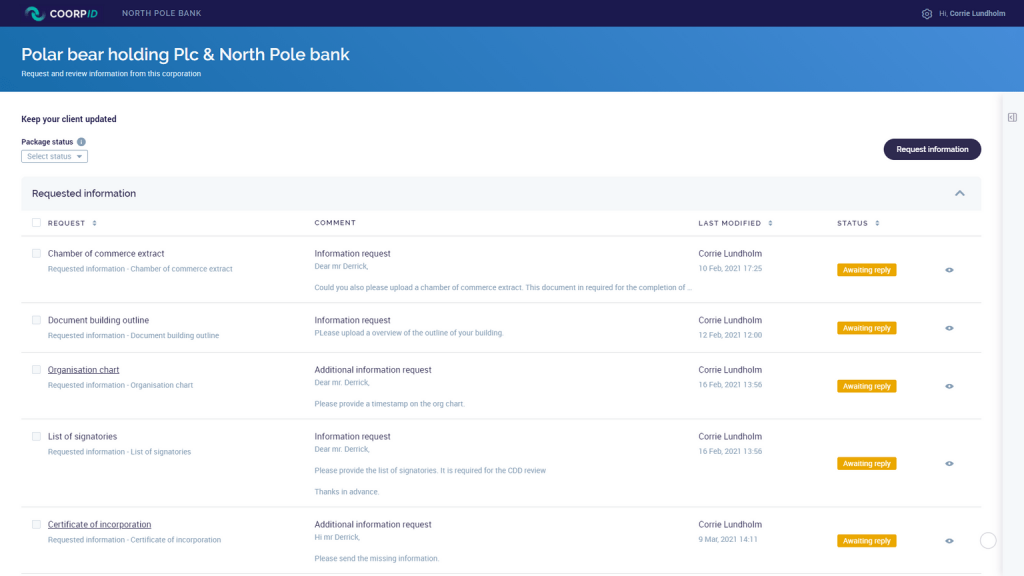

Creating a centralised overview of all KYC data streamlines internal processes. It enables efficient delegation of tasks to colleagues, indicating the real-time status of each document, and showing the completeness of records for each counterparty. A centralised system also sidesteps drawn out and disjointed email chains by allowing banking partners to ask questions or request additional documents via one platform, notifying the client when a document needs attention. At the same time, it can provide a full audit trail of the KYC process and any associated discussions.

Central repository technology also addresses many security concerns, providing end-to-end encryption and electronic authentication not available in email traffic, and removing the need for third-party involvement. The client retains complete control of all data by consenting to specific access.

A smooth KYC process is based on a foundation of collaboration and efficient information sharing. Having this in place allows your organisation to focus on what is important – doing business – and this is where the right technology can have a significant impact on your bottom line.

CoorpID solves the problem of disorganised KYC data for both financial institutions and customers by offering an intuitive solution that gives a real-time overview and a central location to store and manage all KYC-required data. This centralised hub is designed to maximise the quality of the KYC process for both parties by streamlining collaboration, driving efficiency and providing the highest levels of security.

To discover how CoorpID can significantly reduce the time and money spent on KYC in your business, talk to one of our experts today. Click here to learn more.

[1] Money Laundering: the Importance of International Countermeasures–Address by Michel Camdessus. (2015, September 28). IMF. https://www.imf.org/en/News/Articles/2015/09/28/04/53/sp021098